Understanding POS Transaction: How It Works and Why It Matters

The retail and business environment of today moves fast, and the use of POS transactions is the main factor that makes sales operations efficient, safe, and combining them. POS systems ensure that every transaction, ranging from a cup of coffee and groceries to retail sales, is done without any errors and effortlessly.

The companies’ adoption of digital transformation is the driving force behind the growing need for understanding the inner workings of POS transactions. This insight is vital for the areas of customer service improvement, management of digital transformation of customer-facing systems, and accurate inventory and financial records keeping.

What is a POS Transaction?

A POS (Point of Sale) transaction occurs when a customer pays for a product or service at a physical store, an e-commerce site, or a mobile payment. The term “point of sale” refers to the moment and location where a transaction is finalized.

For instance, when you swipe a payment card or tap a mobile phone at the checkout of a supermarket, a POS transaction is happening. Completing an online shopping purchase is a POS transaction too.

You can process a POS transaction in a:

- Physical POS machine (which is located in a store or a restaurant).

- Online POS systems (like e-commerce websites).

- Mobile POS applications (which are used by delivery service providers, pop-up shops, and vendors).

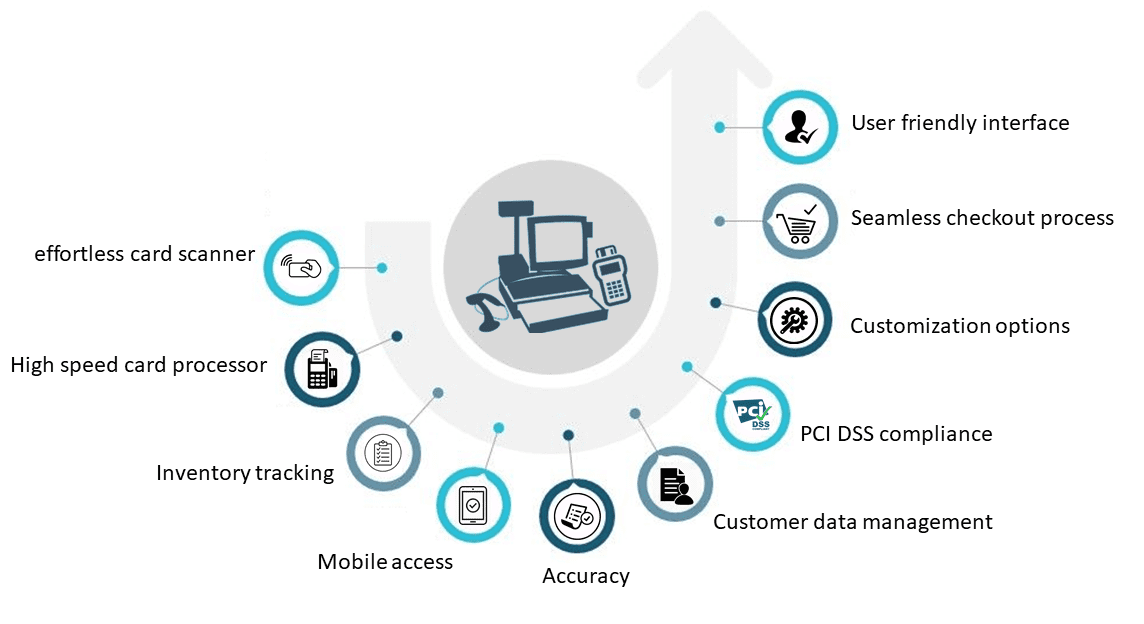

Benefits and Importance of POS Transactions

Here are some important points explaining why the POS transactions are essential for modern-day businesses:

1. Speed and Efficiency

The whole process takes a few seconds, resulting in a quicker checkout and a more satisfied customer.

2. Accurate Sales Tracking

Sales are automatically recorded by POS systems, which in turn reduces manual errors and makes the bookkeeping process easier.

3. Inventory Management

Every sale instantaneously reduces the quantity in stock, thereby making it easier for businesses to keep track of their best sellers and restocking periods.

4. Secure Payments

Up-to-date POS systems are equipped with encryption technology for the data they transmit as well, and they are also PCI-compliant, which together makes credit card transactions secure.

5. Multiple Payment Options

Payment methods such as cash, debit/credit cards, QR codes, and digital wallets are available for customers, making the process a lot easier.

6. Better Customer Insights

Information from POS is useful in examining the buying behavior pattern, busiest hours, and top-selling products for smarter business decisions.

How POS Transactions Work (Step-by-Step)

Even though a POS transaction might look to be taking place in no time, there are a lot of processes and activities happening in the background, and these processes are completed in just a few seconds. Allow us to provide you with a complete explanation:

Step 1: Product Scanning or Selection

The scan of the product’s barcode is performed by the cashier, or the product is put into the digital cart. The price is retrieved by the system and added to the total bill.

Step 2: Payment Initiation

The customer specifies the form of payment—credit card, cash, or digital wallet.

Step 3: Authorization Request

For the card or online payment, in that case, the POS system sends a request to the payment processor or bank asking for authorization.

Step 4: Transaction Approval

The bank verifies the availability of funds or credit and either sends back an approval or a decline message.

Step 5: Receipt Generation

The POS, upon payment approval, automatically prints or emails a receipt, decreases stock, and records the transaction in the system.

Step 6: Data Sync and Reporting

The POS database maintains a secure record of all transactions, which is regularly synce with the sales and accounting records for reporting and analytics.

Common Mistakes and Myths About POS Transactions

Besides, even though POS systems make sales easier, companies sometimes commit little mistakes that lead to major problems. Let’s talk about these mistakes:

- Myth 1: Only large stores can benefit from POS systems

Today’s POS systems are cost-effective and can be adapt to different business sizes—they can even be use by small shops or solo workers.

- Myth 2: The Internet is a must-have all the time

Reality: A good number of POS systems can operate offline and later synchronize data when they are connect to the internet.

- Myth 3: Credit card transactions are not secure.

Reality: With the use of strong encryption, tokenization, and compliance with PCI-DSS requirements, the modern-day POS systems are considere to be safer than traditional manual cash handling.

- Mistake 1: Giving no attention to software updates

Not doing updates will lead to poor performance or vulnerability in security. So, always keep your POS software up-to-date.

- Mistake 2: Not providing proper training to staff

Your POS system can be the best, but it will still fail if your staff is not properly traine. Training will help in smooth operations and will also reduce errors.

Expert Advice and Industry Stats

To grasp how the necessity of POS transactions is rising, we will discuss a couple of insights:

- Statista (2024) states: The worldwide market of POS software has already surpassed $20 billion and is project to reach the same amount again by the year 2030.

- 70% of the entire retail sector has already switched over to a cloud-based POS system for performing operations in different locations as well as managing their inventory.

- The use of contactless payments has more than doubled since the year 2020, and this has resulted in many retailers moving towards digital POS installations faster.

- PCI DSS compliance is still regarde as the best method of securing payment data transferred through POS transactions.

Tip from the Expert:

While choosing a POS system, you should always give more weight to:

- Data security, along with backup facilities.

- Linkage with accounting software.

- Support for multiple payment modes.

- Easy-to-use interface and analytics dashboard.

Conclusion

A point-of-sale transaction is merely the tip of the iceberg when it comes to payments; in fact, it is the nucleus of the current business processes. The fitting POS system that is implant into your business can manage your entire operation, recording each transaction and controlling inventory, and even presenting the data to help you predict and satisfy customers better.

No matter if you are running a cafe, a retail shop, or an online store, a reliable POS solution will turn you into a smarter, quicker, and more secure owner.

1. What Is The Primary Goal Of A POS Transaction?

A POS transaction is a fast and accurate payment processor that also updates inventory and sales records concurrently.

2. Is A Pos Transaction Applicable Only To Card Payments?

Various types of payments are use in POS transactions, including but not limited to cash, cards, mobile payments, and even online transfers.

3. Are Pos Systems Internet-Dependent?

Many types of POS systems function without the internet and synchronize data once connectivity is restore.

4. What Are The Benefits Of Using Pos Systems For Small Businesses?

Savings in time, the prevention of manual errors, stock control, and an improved customer checkout experience are the major benefits, among others, offered.